Some entrepreneurs build businesses with the primary goal of selling to a strategic or financial buyer. For these individuals, the issue of their company’s “sellability” is paramount. But many business founders do not consider their company’s sellability until circumstances – a desire to retire, a need for liquidity, changes in the marketplace, and so on – force them to. There are good reasons for them to consider how to prepare for a business sale much earlier.

Table of Contents

- What is Sellability?

- What Makes Your Company Sellable?

- Focus on Sellability – Even if You’re Not Selling Soon

- So What’s Next? Plus, a Quick Sellability Scorecard

There are two main reasons why considering small business sellability is important for a business owner to consider, even if you are not ready to develop an exit strategy right now.

First, you never know when an attractive opportunity to sell based on a strong business valuation will present itself, or an unforeseen need for capital, such as an attractive investment opportunity, medical emergency, lawsuit, or other event, will arise. Since the steps involved in optimizing a company’s sellability often take months or years – hiring new managers, creating an audited history of financial performance and growth, building diverse customer relationships, and so on – it makes sense to get started as soon as possible.

Second, the process of analyzing your company’s sellability ranking will reveal its financial health, unearth operational shortfalls, bring to light strategic opportunities, and highlight ways to optimize your management. In most cases, this will meaningfully improve the performance of your business.

We will examine these benefits in more detail after we define sellability and its principal components.

What is Sellability?

Sellability is a measure of a company’s attractiveness to would-be buyers. Even motivated buyers – strategic acquirers keen on your intellectual property or market position, or financial buyers swollen with uninvested cash – are choosy. They scrutinize potential acquisitions on a number of criteria. The main ones were distilled into a “sellability score” by John Warrillow, who published it in his 2011 book, Built to Sell: Creating a Business That Can Thrive Without You.

Bear in mind that every business has unique elements, and it is usually wise to consult an experienced financial advisor and/or business broker to determine your specific strategy and priorities. However, generally speaking, the higher your company ranks on Warrillow’s sellability scale, the more attractive it will be to prospective buyers and the more attractive asking price you are likely to attract during the sales process.

What Makes Your Company Sellable?

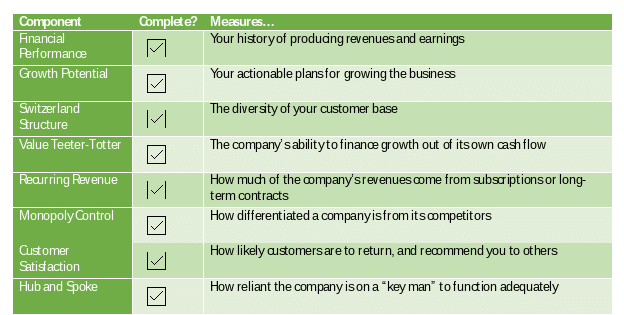

Here is a brief overview of the eight components of the sellability score. You can use the summary in Figure 1 as a checklist to ensure you consider each of them during the entire process as they apply to selling a small business.

1. Financial Performance

Prospective buyers will want to see several years of accurate financial statements and tax returns reflecting the value of your business assets and growth in business value, revenues and earnings. The credibility of those reports is important to buyers, so it makes sense to have them audited by a trustworthy third party, supported by robust internal accounting and financial systems.

2. Growth Potential

Potential buyers are not paying for past performance. They want to ensure that the company has a viable plan for expanding the business over time. Perhaps this is through the application of existing systems and approaches to new markets or products. Or it could be through systematic mergers and acquisitions. In any case, buyers will want to know that they will get a healthy return on your company through the exploitation of growth opportunities that you have identified. The better these have been articulated and pursued, the higher your sellability score, and the higher your potential fair market value.

3. Switzerland Structure

This element of the sellability is a take on the Swiss history of neutrality and self-sufficiency. Unfortunately, companies that emulate this structure – relying on one or two big clients rather than a host of smaller ones – are at the mercy of those big customers and could have trouble if they find other suppliers. Reducing the Switzerland Structure by diversifying your customer base increases your sellability score.

4. Value Teeter-Totter

Buyers value companies that can finance operations and growth out of cash flow, rather than through borrowing or additional equity rounds. Boosting your cash flow by stretching payables and accelerating receivables is often recommended in this regard.

5. Recurring Revenue

A company’s revenues are seen as more stable by buyers if it has recurring revenues from subscriptions – especially those with auto-renewal provisions – and contracts. The steadier a company’s revenues, the higher its sellability score.

6. Monopoly Control

This is a factor reflecting whether you have built – and patented – the apocryphal better mousetrap. If your goods or services cannot be replicated or commoditized by your competitors, your sellability score rises.

7. Customer Satisfaction

This element of the sellability score is key to retaining clients and fostering word-of-mouth growth. Finding ways to document it in a credible way to show to potential clients is crucial.

8. Hub and Spoke

This refers to your company’s reliance on you, the top manager. If nothing can get done without your guidance or approval, your company will not be a particularly attractive acquisition candidate, since you will, in most cases, leave at or within a negotiated period after the deal closes. You need to take the time to develop a deep bench of key employees and capable executives, delegate important decisions to them, and then go on vacation to see if the company still flourishes in your absence.

Figure 1: The “Sellability Score” Checklist

Source: Built to Sell: Creating a Business That Can Thrive Without You, John Warrillow, 2011

Focus on Sellability – Even if You’re Not Selling Soon

The reasons for focusing on sellability, even if you do not plan to sell your firm soon, revolve around how the process can improve your business. Here are some of the main benefits.

It Optimizes Operations and Finances

Getting your financial records in order, having them audited by a third party, hiring a deep bench or managers that you feel confident can manage the firm, examining your customer base and the types of revenues it provides – all these steps help surface inefficiencies, risks, and opportunities for improvements. Getting your firm into sellable shape means, fundamentally, getting it into the best shape possible, which will pay off for you as long as you are the owner.

It Increases Your Options

Eliminating the hub-and-spoke structure will give you the latitude to explore other revenue streams, other business opportunities, and, of course, the possibility of exiting the business if the time seems right.

It Clarifies Your Net Worth

If your business’s financials are not in order, and you do not have good projections about the potential value of your company’s investments, you probably do not know how much your company is really worth. If, like many business builders, much of your net worth is tied up in your company, that means you do not know your own worth. Getting your firm’s financial reporting and projections in order will give you a better idea of your own financial position.

Done correctly, increasing your company’s sellability should reduce your managerial headaches, increase your financial options, and boost your business’s prospects.

So What’s Next?

The time to get started is now, and if our team at DGP Capital can be of assistance to you, please know we would be honored to assist you. If you’re still unsure about your next practical step, please be our guest and try out this complimentary Business Value Builder Scorecard Tool to see where your company currently stands.