Forbes: A Guide To EBITDA Multiples And Their Impact On Private Company Valuations

This article by Jack Chang was originally published on Forbes.com. Read the full article here.

How might interest rates impact valuations of privately held businesses? The main question we feel is relevant to valuations for any business owner is, how much additional growth a company would need to have so it could counteract any contraction in market valuation multiples.

In this article, we dive into a few scenarios illustrating why contemplating a transaction when valuations are at all-time highs makes the most sense, especially if it’s clear that rising interest rates will impact valuations going forward.

Table of Contents

- Understanding What Happens When EBITDA Multiples Contract

- How to Get the Same Valuation When Multiples Drop

- Increasing Revenues/Sales to Achieve the Same Valuation at the Peak

- Wrapping It All Together

Understanding What Happens When EBITDA Multiples Contract

A vast majority of all private company transactions are valued on an Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) basis; simply put, EBITDA is multiplied by a factor (i.e., commonly referred to as the EBITDA multiple), resulting in a valuation. The resulting product of EBITDA and EBITDA Multiple is the Enterprise Value of the company.

To illustrate, assume that your company’s Trailing Twelve Months (TTM) EBITDA is $8 Million; assuming that average EBITDA multiples for privately held companies in this size range is 8.0x, this further implies a current valuation of $64 Million in enterprise value.

If there is a contraction in valuation multiples across the board due to rising interest rates or other macro factors, it goes without saying that there would be a direct impact on valuation. Valuation multiples could see a contraction of 1.0x or more, from current peak levels, if supply of actionable deals begins to outstrip demand. In this case, a 1.0x decline in EBITDA multiple would imply a 7.0x multiple, resulting in a $56 Million valuation. This would be a $8 Million decline in enterprise value, or a 12.5% decline in value.

The table below summarizes this scenario:

| Current Market | Down Market | |

| EBITDA ($MM) | $ 8 MM | $ 8 MM |

| Multiple | 8.0x | 7.0x |

| Implied Valuation | $64 MM | $56 MM |

| % Decline in Valuation | – | 12.5% |

Figure 1: Example of EBITDA Multiple Contraction

How to Get the Same Valuation When Multiples Drop

As multiples drop, business owners are often taken off guard when the offers they receive are lower than prior offers or estimates. Unfortunately, it’s a simple calculation – lower multiples result in lower valuations. But how does a business make up for this drop in multiple, and still receive the same valuation, from a raw dollars point of view? The question then becomes: how much does EBTIDA need to increase to make up for the decline in multiples?

To answer this question, we’ve utilized the various scenario analyses to determine the amount by which EBITDA and revenues must increase to counter-act specific declines in EBITDA multiples.

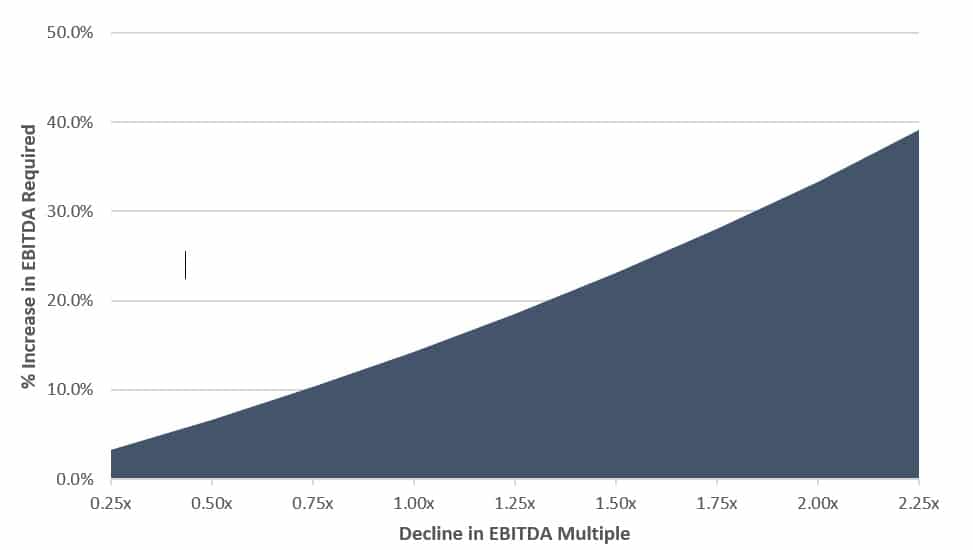

The graph below further illustrates the amount of EBITDA growth required to offset declines in valuation multiples:

Figure 2: Required EBITDA Increase (%) to Off-Set Decline in EBITDA Multiple

Let’s assume that the same conditions in the example illustrated in Figure 1 apply, whereby a business with $8mm EBITDA trades at a 8.0x EBITDA multiple will have an implied enterprise value / valuation of $64 Million. The chart in Figure 2 above calculates the required % of EBITDA growth required for each 0.25x drop in EBITDA multiple.

As illustrated in the chart, a 2.0x drop in EBITDA multiple (e.g. going from a 8.0x to 6.0x multiple), will require the business in this example to increase it’s EBITDA by 33% to achieve the same $64 Million valuation. That’s nearly a $2.7 Million increase in EBITDA, which is quite an difficult task to accomplish with strictly organic, steady-state growth.

Increasing Revenues/Sales to Achieve the Same Valuation at the Peak

Now that we’ve illustrated the concept of how a decline in EBITDA multiples impacts valuation, and how a business must increase its EBITDA to counter-act a drop in multiples from peak valuations to achieve the same value, it’s time to explore these concepts in more practical terms.

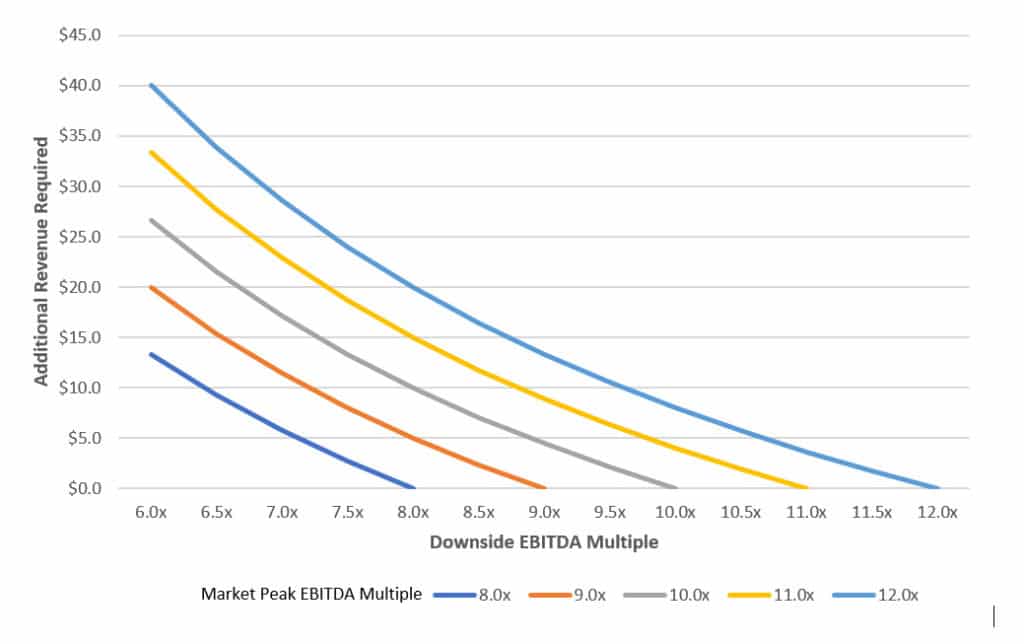

In order to analyze some of these scenarios and to provide a practical context, we’ve included the chart in Figure 3 below that compares the amount of additional revenue required to achieve the same valuation at the peak of the market, based on how far the EBITDA multiple drops. The chart in Figure 3 also takes into consideration the EBITDA multiple at the peak, and assumes a $8 Million EBITDA at 20% EBITDA margins.

Take for example a company that currently has $8 Million in EBITDA and at today’s peak valuations, would achieve a 8.0x multiple, resulting in a $64 Million valuation; now assume that 3 years from now, EBITDA multiples/valuations across the board decline by 2.0x, and at that point, this same company would only receive a 6.0x multiple, for a $48 Million valuation.

To receive the same $64 Million valuation as it would today, this same company would have to increase its revenues by over $13 Million (assuming a 20% EBITDA margin), to get to the same $64 Million valuation as it would have achieved at the peak. Clearly, this is a tough hurdle to overcome for any business.

In other words, a business with a higher EBITDA and/or higher peak valuation multiple will require a different amount of growth to counteract a drop in valuation multiples. If, as a business owner, you are wondering how much more revenue or sales your business must generate in order to counter-act a decline in valuation multiples, the short answer, as illustrated above, is, it depends.

Wrapping It All Together

So what does this all mean and why should any business owner care? At DGP, we often hear prospective business owners say, “my business is doing great, I don’t think it’s time to sell, even though I’m looking at retirement or an exit within the next few years”.

Here’s the issue with that line of thinking: if you wait long enough in a peak M&A market, you’ll likely see valuation multiples drop, especially in a situation where interest rates are rising. With that drop in valuation multiple, your business will have to increase its EBITDA by a meaningful amount so that you are able to achieve the same valuation that you would receive today, given the current frothiness in the market.

With valuations current near the peak of a cyclical M&A market, now may be an appropriate time to contemplate either a complete or partial exit in order to maximize the valuation received for your business.

This article by Jack Chang was originally published on Forbes.com. Read the rest here.