Mid-market M&A activity in the industrial and manufacturing sectors enjoyed a significant uptick in 2021 as pandemic restrictions eased and pent-up demand was released, and 2022 is set to deliver even more deals as the economy continues to grow.

For dealmakers in the US, these are golden times. After the chaos of the pandemic in 2020, which significantly impacted M&A activity for much of the year, 2021 made up for it in some style – and at all levels.

In the first three quarters of the year, mid-market M&A deals – those valued at or below $250 million – were up by about a third year-on-year in volume, with the total value of those deals up by nearly half.

Bigger deals were also back en vogue, with transaction with an enterprise value of more than $1 billion more than 100% up on 2020 for the first nine months of the year.

M&A activity has grown in many sectors across the year in the US, including in manufacturing and industrial, which we specialize in.

Manufacturing And Industrial Sectors

However, as manufacturing and industrial businesses resumed operations at near pre-COVID levels in 2021, especially after the rollout of various vaccines across the nation, dealmakers returned to the table – be that physically or through video conferencing apps. But it wasn’t just the reopening of the economy that has driven M&A activity. Other factors at play included pent-up M&A and investment demand from the previous year, as well as the potential implications from a rise in capital gains tax and favourable business valuations.

In the industrial sector, deal multiples have been above historic levels in 2021 as acquirers have been willing to pay a premium for businesses that diversify their markets, create strategic synergies and economies of scale and make supply chains more robust. Indeed, COVID highlighted the importance of supply chain diversity and near-shore/domestic manufacturing capabilities, and this drove M&A demand in various sub-sectors throughout the year.

Likewise, the manufacturing sector has also enjoyed one of its most active years for mid-market M&A activity in some years, and in some cases sale prices have been above list price.

In the wider manufacturing and industrial sectors, certain sub-sectors have enjoyed strong growth in the past year – such as air purification manufacturing – which has inevitably led to M&A activity, both existing businesses acquiring rivals to enhance their market share and businesses from other sectors looking to gain a foothold in a developing and growing market.

Private Equity Impact

Key Performance Indicators are quantifications of how well your business is attaining your company-wide objectives. This is a strategic assessment tool. In other business literature, what we are speaking of he

Private equity firms have also been active over the past 12 months. Many had large amounts of pent-up capital to invest, having had several pandemic-affected quarters, and proceeded to make up for lost time.

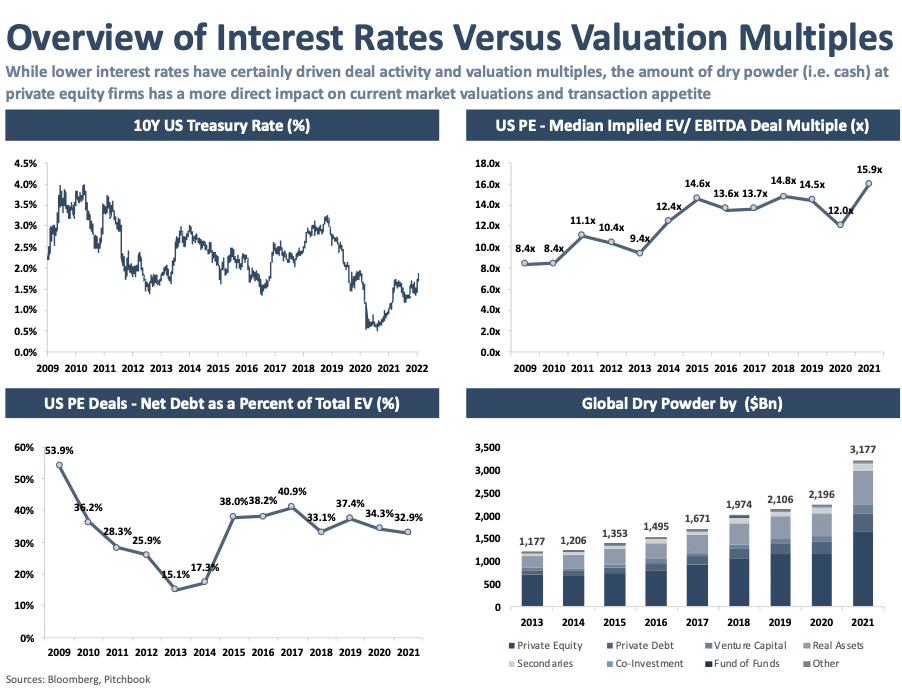

Indeed, the global amount of dry powder private equity companies had at their disposal was up by nearly 50% year-on-year in 2021 to $3,177 billion, and this had an impact on the appetite for transactions and market valuations.

As a result, the US private equity median implied EV/EBITDA deal multiples climbed from 12x to 15.9x during 2021, again rates that haven’t been seen since before 2009.

Meanwhile, unsurprisingly given the level of dry powder in the market, US PE deals with net debt as a total percentage of EV fell in 2021 to 32.9% – levels not seen since 2014 when net debt levels were half that figure. This continued the steady fall in net debt as a total percentage of EV levels seen since 2019.

That said, lower interest rates in the US have also driven deal activity and valuation multiples. While interest rates steadily climbed during 2021, benchmark 10-year Treasury rates have remained below 2.0%. Our view is that while interest rates have historically impacted valuation, the higher levels of dry powder will continue to drive M&A appetite, and mute some of the impacts associated with rising benchmark interest rates. The charts below further illustrate this point:

Outlook For 2022

M&A statistics for Q4 are expected shortly but should confirm the ongoing renaissance of dealmaking: economic activity continued to accelerate throughout the second half of 2021 and the US economy grew strongly, as did the manufacturing and industrial sectors. Many businesses were still looking to make up for lost time and return to and even exceed pre-pandemic levels of activity. This heightened level of M&A activity is expected to continue into 2022 as businesses indicate a growing confidence, despite the problems the Omicron variant of COVID-19 has caused with labor shortages and supply chains recently. Indeed, it has caused the International Monetary Fund (IMF) to downgrade its forecast for the growth of the US economy in 2022. It is now expected to grow by 4% in 2022, having expanded by 5.6% in 2021. Global economic growth is projected to be 4.4% this year.

That said, the effect of Omicron variant is anticipated to ease after the first quarter of the year, which means that, barring any new variants appearing, economic activity can resume to something approaching normal again.

With relatively strong growth predicted for the economy in the US, it follows that M&A activity will continue at a healthy rate too. While much of the pent-up demand from 2020 has now been released, there are likely to be some deals in protracted negotiation that are still to complete.

There will be more opportunities for acquisitive companies too. In the manufacturing and industrial sectors, there are companies still feeling the effects of the 2020 lockdowns and will be ripe for acquisition. Others may have put off exit strategies until economic conditions regained some stability and so will be looking to sell up in 2022 for a competitive price.

Another strong driver of M&A activity is the desire to scale, with acquirers looking for strategic acquisitions that bring about greater efficiencies – in administration and production – and cut costs.

For those businesses that are confident and in a healthy financial position, 2022 could be the year to execute on an M&A strategy as there will be bargains available that can deliver value.

Looking even further ahead, the IMF anticipates that growth in the US economy will ease further in 2023 to 2.6%. However, that is still good for a mature economy, and indicates that conditions will remain favorable for dealmaking.

Getting Advice

To understand the difference between strategy and tactics, we’ll use an example from military history. Take for exa

With M&A activity so high currently, it is perhaps more crucial than ever that businesses looking to sell, buy, or explore refinancing and recapitalizations, receive the right advice to ensure any transaction they may contemplate is at the right value and can deliver the anticipated benefits.

DGP Capital is an industry-focused investment bank and M&A advisory firm, providing our clients with industry-leading advice, covering all aspects of a transaction. Our deep knowledge and technical experience, especially in the industrial and manufacturing sectors, is above what you might find at a typical investment bank or M&A advisory firm.